En ce moment

Algeria ranks first among countries in terms of oil exploration in Africa

Gaza: What is the reality of the economic situation in the Palestinian Territories?

Israel: The economic situation is deteriorating and the markets are granting it less favorable conditions

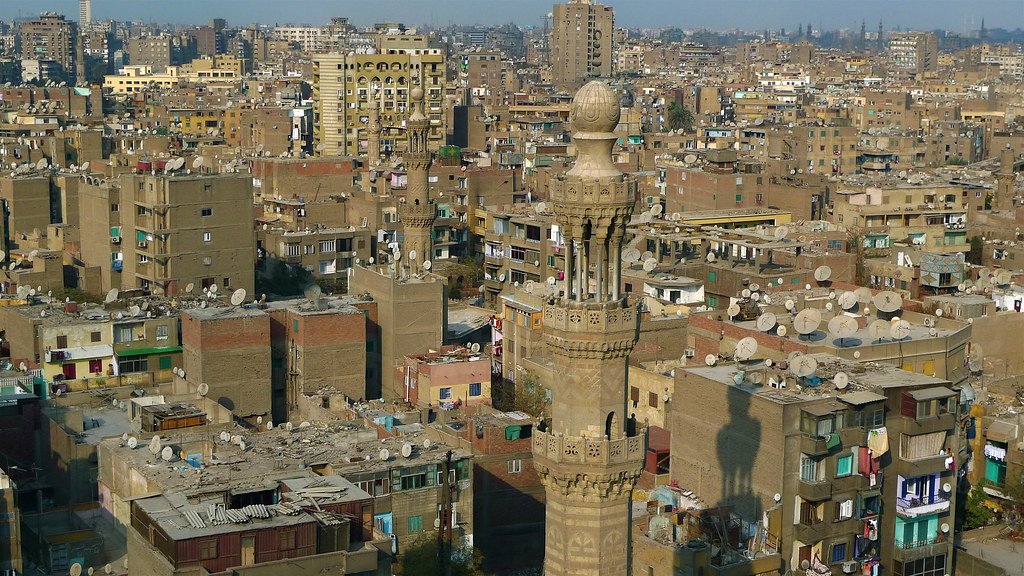

Egypt and China sign new agreements to consolidate the two countries' global strategic partnership

Libya sees its economic growth forecast lowered to 7.7% in 2024 compared to a previous estimate of 9.5%

Réagissez à cet article