In 2021, SDX Energy recorded operational difficulties in North Africa which are weighing on its company cash flow and investments.

On March 18, British producer SDX Energy announced that it suffered a total loss of $24 million over the past year as it was forced to write off the costs of failed projects in Egypt and Morocco.

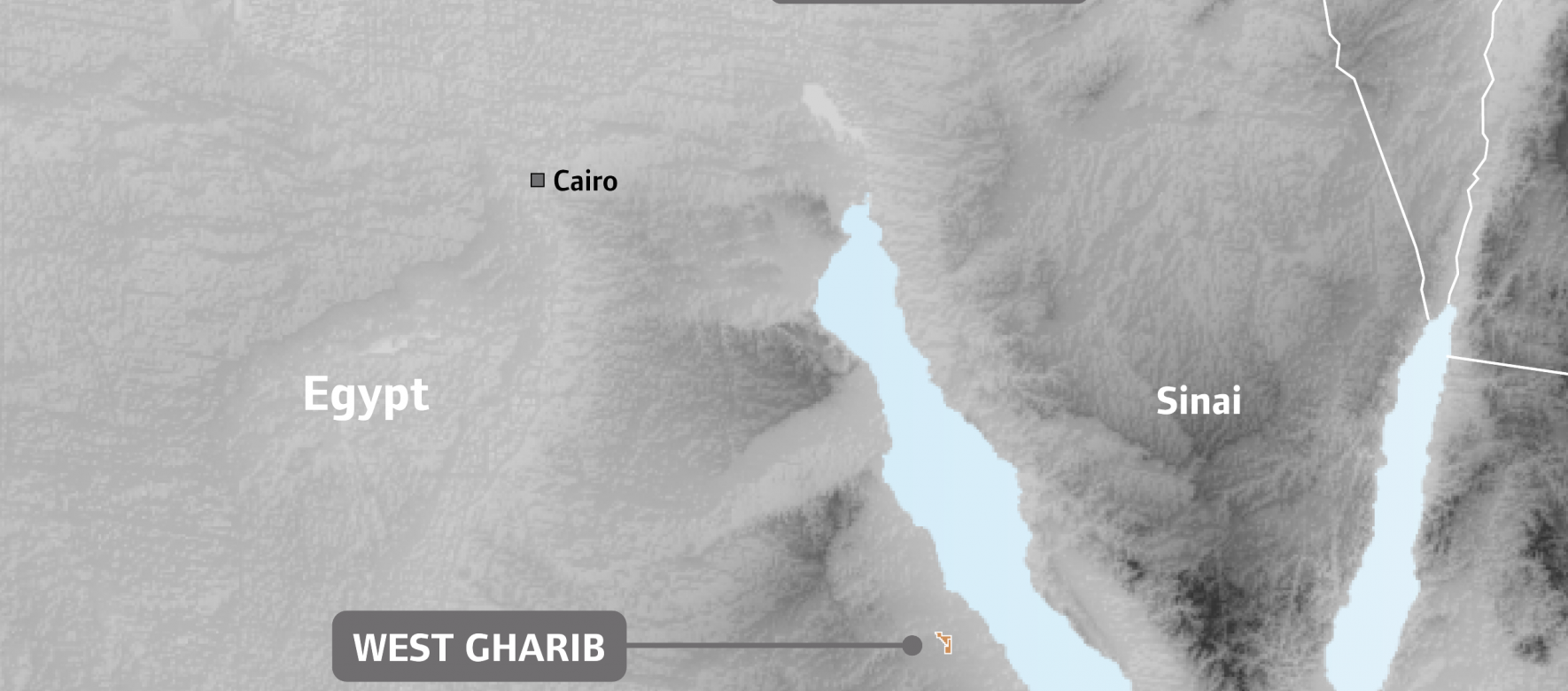

Indeed, the company failed to find oil or gas during the drilling campaign of a lateral well on the Hanut prospect of the South Disouq concession in Egypt. It is therefore selling 33% of its shares on the spot for $5.5 million and retaining 66% to continue generating income while reducing risk exposure on two other exploration wells to be drilled this year.

The white cabbage seen on Hanut resulted in a writedown of $1.3 million, which is in addition to another non-cash writedown of $9.5 million, after a downward revision of recoverable reserves held on producing fields from SDX. In 2022, South Disouq will see its production drop to 2,280 barrels of oil equivalent per day, due to planned maintenance work and well workovers.

In Morocco, the company said it recorded a non-cash charge of $10.3 million, before it relinquished the Lalla Mimouna Nord concession. However, it announced last year three drilling successes on the wells in the Gharb basin: OYF-3, KSR-17 and KSR-18 which will be launched in the second quarter of 2022.

Réagissez à cet article