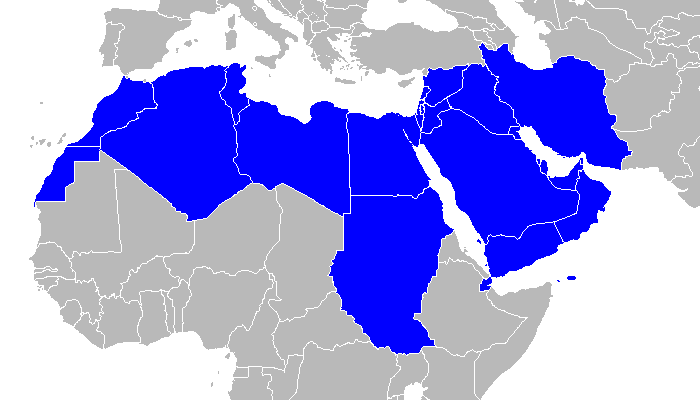

The Middle East and North Africa (MENA) region has seen a strong economic recovery in the second half of 2021 and production has recovered to pre-COVID levels in several countries. Economic outcomes have been uneven across the region, depending on the severity and effects of the pandemic.

In Saudi Arabia, the increase in oil production has been accompanied by a recovery in the non-oil sector made possible by the acceleration of vaccination. The pandemic had a relatively limited effect on the services sector in the Islamic Republic of Iran, while oil production and industrial activity rebounded. The Egyptian economy grew faster than expected in the 2020/21 fiscal year, supported by strong consumer demand, increased remittances and more subdued inflation than in previous years.

In Tunisia, the recovery has been held back by the spike in COVID cases in mid-2021 and new travel restrictions, as well as political uncertainty over the past year.

Consumer price inflation in the region remains below the long-term average (except in Lebanon and the Islamic Republic of Iran), owing to weak demand, combined with still negative output gaps and, in number of countries, fixed exchange rate regimes.

For what prospects?

As contact-intensive sectors recover and oil production cuts fade, coupled with accommodative policies, growth in the region is expected to accelerate to 4.4% in 2022, or higher than the rate forecast in June 2021, before slowing to 3.4% in 2023. The gap in average per capita income between countries in the region and advanced countries is, however, expected to widen over the forecast period.

Higher oil and natural gas prices and increased production should benefit energy exporters. In Saudi Arabia, the oil sector is expected to rebound, which will boost exports, while high vaccination rates and accelerating investment will support non-oil activity.

In Iraq, production is expected to increase by 7.3% in 2022, driven by the oil sector. The projected growth rate for 2022 in the Islamic Republic of Iran has been revised upwards given the gradual recovery of the oil sector and the easing of travel restrictions imposed due to the pandemic.

The near-term outlook has also improved for oil importers. In Egypt, production is expected to increase by 5.5% in the fiscal year to June 2022, due to improving external demand from the country’s main trading partners, expansion of technology sectors information and communication as well as extractive industries (gas), and the progressive improvement of tourism.

In Morocco, on the other hand, the economy is expected to accelerate by only 3.2% in 2022, a lower rate than expected in June 2021, due to the slowdown in agricultural production.

For what risks?

New outbreaks of COVID-19, social unrest, high debt levels in some countries, and conflicts could dampen economic activity in the MENA region. The rapid spread of the Omicron variant could dampen global demand and lead to lower oil prices.

Fluctuations in oil prices could weaken activity in the region, creating losers and winners among oil importers and exporters, as the case may be. Underinvestment in the sector could prevent exporting countries from taking advantage of high oil prices. The rapid spread of the Omicron variant could dampen global demand and lead to lower oil prices.

The proliferation of natural disasters linked to climate change is jeopardizing the existence and livelihoods of populations in the region. Over time, rising temperatures would reduce cultivated areas, agricultural yields and already limited water resources, which could compromise food security, lead to population displacements, reduce labor productivity and increase the risk of conflict. .

Source: The World Bank January 2022

Réagissez à cet article