Ten years from now, Israel should be running on two locally sourced energies, gas and the sun. This development will have significant economic consequences because it will ensure the country's energy autonomy. In addition, Israel's gas resources and its clean electricity needs will develop the interconnection of energy networks with its neighboring countries.

Israel is aiming for, at best, a neutral greenhouse gas balance by 2050 and the Ministry of Energy estimates that at this stage the implementation plan achieves 85% of this objective.

The decision was taken to do away with coal (28% of electricity production today) by 2025. In 2030, energy needs should be covered thanks to off-shore natural gas, the internal consumption of which will then have doubled in fifteen years (the exploration of terrestrial gas is prohibited) and to renewable energies (30% of the energy mix).

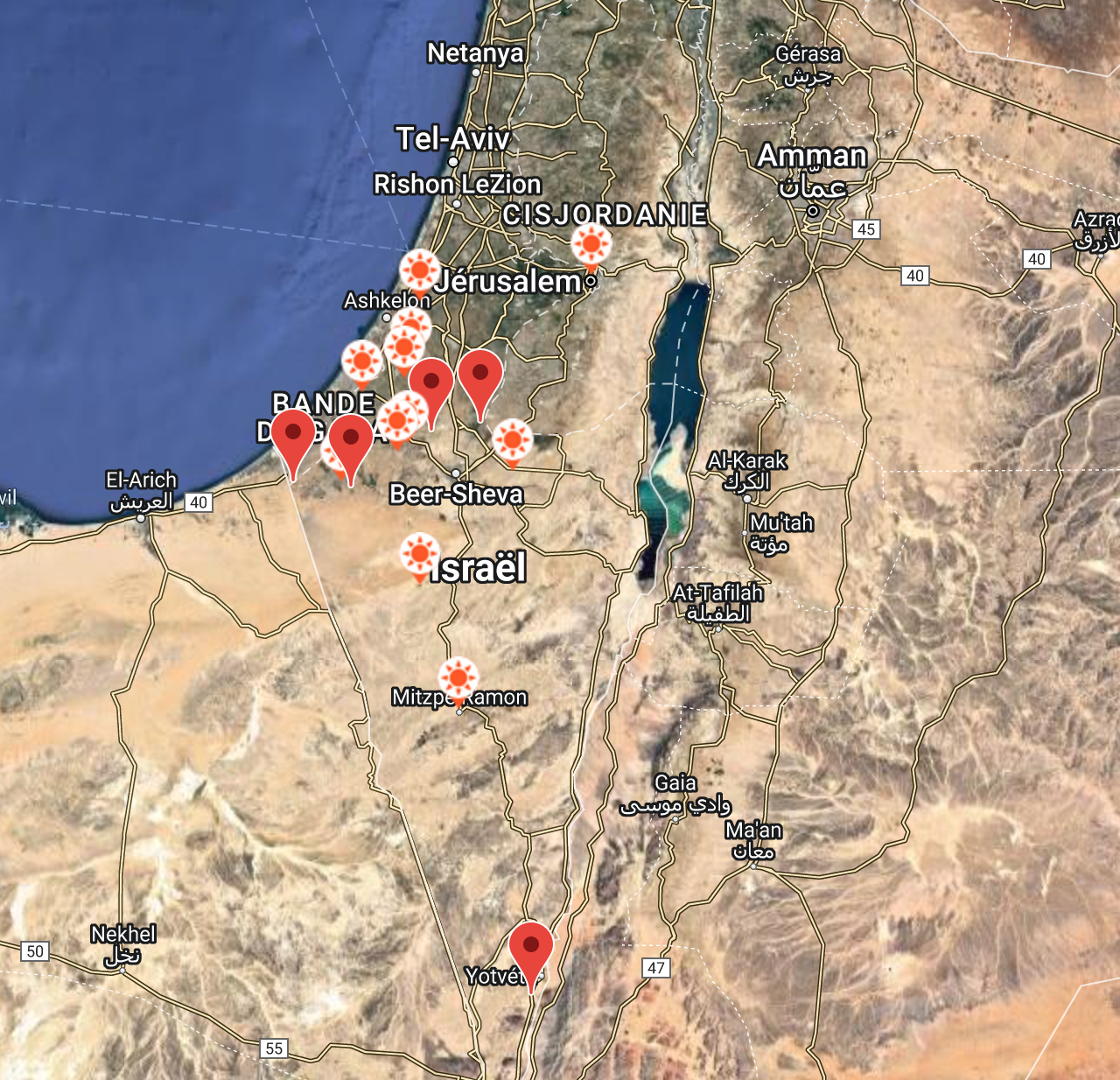

The development of renewable energies is essentially based on that of solar energy (EDF Renewables Israel is currently the undisputed leader with around twenty power plants operational or under construction) but also on the development of storage. In the Negev, there are only 18 days on average without sunshine per year, but Israel will quickly have to rely on its neighbors to reach its target of 30% solar energy.

Indeed, 60% of the Israeli desert is closed to the installation of solar power plants (military land and geographical constraints) and the land problems are even more serious in the center of the country, which is already very densely populated and highly consuming electricity. The establishment of a mini-solar or agri-solar production and distribution system is therefore essential, as electricity from wind power is currently inconclusive in Israel.

The development of electric vehicles must also be supported. The first phase of a modest plan to set up charging stations received public funding of 200 million ILS (55 million EUR); Israel is also working on a demand-smoothing system during nighttime charging in collective housing parking lots.

Institutional and R&D relations with Europe (Horizon Europe program) and the USA (Bird Energy on energy efficiency) are deemed essential by the Ministry of Energy, which stresses that it has relations in this area with the Netherlands and the United Kingdom.

At this stage, Israeli gas exports cannot reach their maximum potential due to transportation bottlenecks. They are in Jordan and Egypt, which is the main customer and transit country for the Israeli gas exported thanks to the Damietta liquefaction train. A proposed gas pipeline could strengthen Egypt’s position by linking Israel to Sinai overland, doubling the maritime gas pipeline that brings Israeli gas to Damietta but lacks capacity.

Since the Eastern Mediterranean Pipeline (Israel Cyprus Greece) gas pipeline project has been abandoned, it is not excluded that the surplus Israeli gas from the Tamar and Leviathan fields could be transformed into alternating current which would then be exported to Cyprus and Greece by an interconnector (high voltage submarine cable) comparable to what exists between France and the United Kingdom or between Norway and the Netherlands.

Finally, an agreement signed in Dubai in November 2021 in the presence of officials from the UAE and the USA, could allow exchanges of water (desalination in Israel and export to Jordan of up to 200 million m3) and electricity (power plants Jordanian solar power plants interconnected to the Israeli grid for the export of 600 MW). This would help Israel to achieve its objectives announced at COP 26 by importing electricity from solar sources but would also intensify trade between two countries that have been officially at peace since 1994.

Israel’s gas windfall is already having effects that have the potential to linger over the next three decades.

Combined with the boom in the “high technology” sector (15% of GDP), the gas resource has contributed to changing a chronic Israeli trade deficit into a chronic surplus in ten years. This strengthens the economy of a country, member of the OECD and accentuates the economic contrast with its neighbors. Subject to the modernization of the Palestinian electricity network (fully integrated with that of Israel with the exception of the Jericho region supplied by Jordan), intelligent management of the Smart Grid type would be likely to make the exchanges of kW/h more fluid thus avoiding the downgrading of certain areas under Palestinian control.

Thanks to the development of the interconnection of the networks (gas and electricity), the energy surplus will offer the possibility for Israel to play a new role in the resolution of the energy crises which periodically shake the region (Egypt, Lebanon, Jordan). The Israeli gas officially exported to Jordan for a few years is already transported by the Pan Arab gas pipeline.

It is also Israeli gas that largely supplies the Gaza Strip and its gas plant. A recent agreement was reached for Qatar to pay (up to 5 million USD per month) for gas deliveries to Gaza. The energy dependence of the Palestinian territories vis-à-vis Israel is therefore combined at the level of primary energy (gas) in Gaza and at the level of electricity as far as the West Bank is concerned.

Source Tel Aviv Economic Service French Embassy

Réagissez à cet article